Signposting to the Shared Fundamentals: PPI >

Editor's note: This post originally appeared on the Impact Management Project blog.

A blog post that I recently read about concepts in ICT for Development (ICT4D) introduced me to the German word ‘Eierlegendewollmilchsau’. Despite having a father who immigrated to the US from Germany and learning German in high school, I had never heard that word before. The idea of an “egg-laying wool-milk-sow” soon made me think of all the things that international development practitioners want a measurement tool to do for them. They want an ‘all-in-one’.

In my work with household poverty measurement and the PPI, it sometimes seems like organizations want a crystal ball to tell them who they are reaching, what they need, how it can be made better, and whether what they did made any difference. In many cases, it’s the donors that are pushing for that information to be magically available.

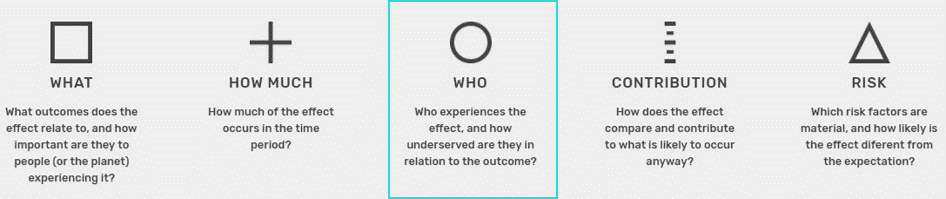

That’s why the five dimensions of impact agreed by hundreds of practitioners through the Impact Management Project are so important. It clearly delineates why they measure, what they want to understand and specifically where various measurement tools and frameworks are relevant.

Using the five dimensions, we can now be clear that all of PPI’s use cases relate to who is being reached. The ‘who’ dimension describes the most relevant unit of analysis for understanding how ‘in need’ the person is in relation to the outcome they seek (‘what’).

If the impact goal(s) of your project or company includes “reaching poor households” as a part of how you understand the who dimension, the PPI is a useful measurement technique. Specifically, the PPI can tell you whether and to what degree the households you are working with experience economic poverty. This is often used as a proxy for being underserved with regard to a number of important positive outcomes. It uses national expenditure data to estimate whether a household is above or below national or international poverty lines. When you apply the PPI to a group of households, you can estimate what proportion of those households are living below the poverty line. You can also estimate the proportion in extreme poverty (below $1.90/day) or less vulnerable to poverty (above $3.20/day).

Catholic Relief Services used the PPI to test how variations in project implementation affected their poverty outreach. The Expanding Financial Inclusion project exceeded its target of 50% of savings group members coming from the poorest half of their communities.

In West Africa, Injaro Agricultural Capital Holdings Limited (IACHL) collects PPI data on customers of its investees. They do this because, as they explain in this blog post, IACHL’s beneficiaries are smallholder farmers cultivating two hectares or fewer. They want to make sure, among other considerations, that people from low-income households are accessing employment through IACHL’s investee companies.

However, the PPI doesn’t tell you what exactly those households need. When we observe economic poverty, we typically also see that people lack housing, health, and resilience, a few specific outcomes identified through SPTF’s experience in the field of microfinance. But just because a household is economically poor, it doesn’t necessarily follow that it is underserved in all aspects of well-being, nor that its needs are the same as others. For example, one low-income farming family may be producing regular income from their crops, but lack access to a toilet. In the same village, their low-income neighbor may have a toilet, but works as a laborer and lacks consistent cash flow. While access to sanitation would help the first family, the second family needs access to financial services.

While the PPI does not tell us what exactly households need without further analysis, the data can help an organization learn more about who they are serving and suggest where they may be underserved in relation to specific, important positive outcomes. The PPI is country-specific and based on each country’s national household income or expenditure survey. The model behind the PPI gives the user a short-cut allowing us to ask just a small number of questions from the national survey (usually 10) and still get a pretty accurate prediction or estimate of the poverty level of the household. In addition to a poverty likelihood, the PPI questions typically provide valuable data about household demographics, housing characteristics and assets.

Some of Oikocredit’s microfinance partners have designed loan products specifically for improving housing conditions for clients who were identified as being potentially underserved in terms of physical infrastructure through the PPI. Through the PPI questions, they had information on the materials used for the roof, floor and/or walls which provided suggestions for further research on what their clients were lacking. Similarly, KOMIDA, a microfinance service provider in Indonesia developed a ‘sanitation loan’ after data from the PPI data supported what an investor had noticed in one branch about clients lacking access to sanitary latrines. KOMIDA now monitors the proportion of its clients who have access to a toilet.

If you want to see if your intervention’s effect is deep, long-term and/or happens quickly (how much) and whether it was better than or worse than what might have otherwise happened (contribution), then the Impact Management Project is a great resource for other tools and frameworks that can complement the poverty information you have from the PPI. For example, the type of research that IPA does is important for understanding contribution and determining which strategies are particularly effective for achieving impact for specific groups of people.